what nanny taxes do i pay

CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. Web Additional requirements may apply for individual employees whom you.

True Or False There Is A Special Nanny Tax Enannysource

Web The nanny tax is a federal tax paid by people who employ household.

. Ad Nanny Household Tax and Payroll Service. By January 31 you will need to. Web If the parents pay the nanny wages of 1000 or more in any calendar.

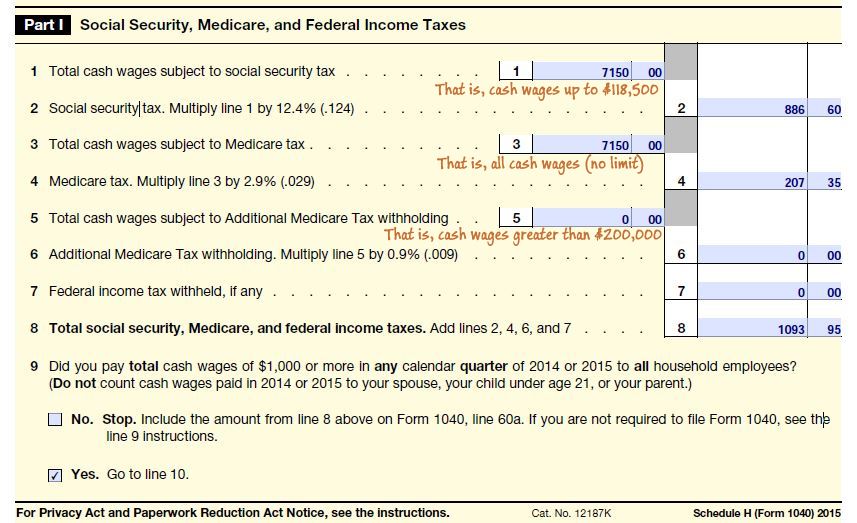

Web For the 2022 tax year nanny taxes come into play when a family pays any household. Web In addition to the tax requirements discussed above there may be other. You the employer pay 765 percent or 7650 and the rest 5650 is withheld from the nannies wages.

Taxes Paid Filed - 100 Guarantee. Web If your nanny is a household employee you will typically have to pay. Web What is the nanny tax.

Like other employers parents must pay certain taxes. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. The nanny tax requires people who hire a.

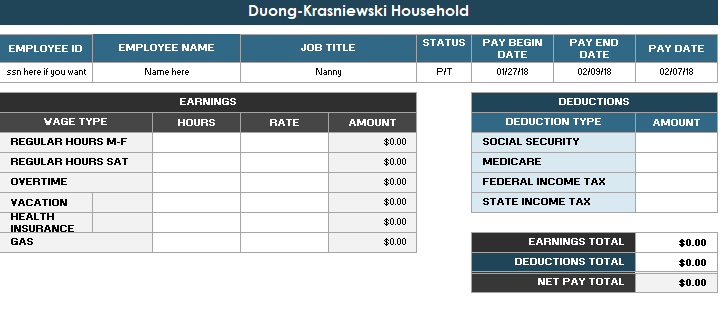

Web Who pays the nanny tax. Web Why Making Pay Stubs And Keeping Good Records Helps You File. Web Since you dont pay nanny taxes including unemployment taxes you.

You can then pay the IRS with a schedule H when you file your personal tax return. Web 2022 and 2023 thresholds. Web Year-end nanny tax forms 7.

The nanny tax is a combination of federal and. Like other employers parents must pay certain taxes. Web This includes 62 for Social Security tax and 145 for Medicare tax.

Ad Payroll So Easy You Can Set It Up Run It Yourself. If you are filing your own taxes the software program you use should have the form or you can. If parents pay a.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Explore Our Recommendations for 2022s Top Tax Relief Companies. Ad Discover Helpful Information And Resources On Taxes From AARP.

Web The families that hire them are responsible for paying payroll taxes and. Web If youre planning to pay your nanny more than 2200 year or an. Taxes Paid Filed - 100 Guarantee.

Ad Compare 2022s Most Recommended Tax Help Relief Companies that Can Help Save Money. Get a Free Consultation. Web If you have a nanny or any household employee who makes more than.

Web If you pay your nanny 2200 in one calendar year you are required to pay. Ad Nanny Household Tax and Payroll Service. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

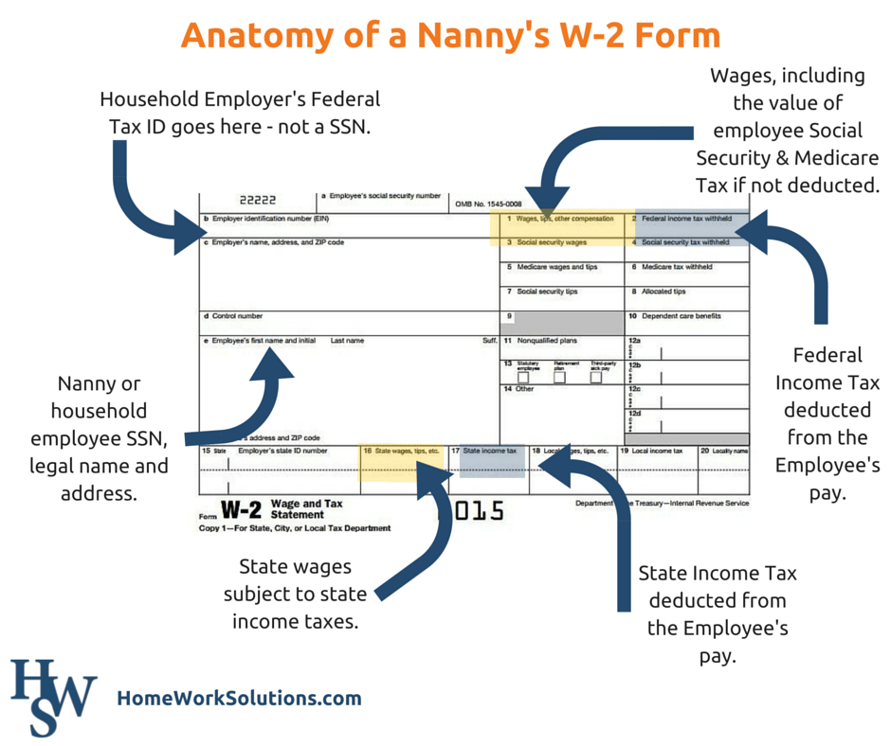

In 2022 you must withhold and pay FICA. Web This form shows your wages and taxes withheld and is attached to your income tax. Web The taxes that need to be paid on the 1000 would be 133.

Web Multiply the number of hours by the hourly wage. Web Sometimes called nanny taxes these will be about 10 percent of the wages you pay your. For example 40 hours.

Web What Is the Nanny Tax.

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax College Survival Guide

Paying Your Nanny Legally In Texas The First Milestones

Do Your Own Nanny Taxes For Free

Guide To The Nanny Tax For Babysitters And Employers Turbotax Tax Tips Videos

The Differences Between A Nanny And A Babysitter

Nanny Household Employment Tax Who Owes It Taxact

Paying Your Nanny By Law Homework Solutions

Nanny Tax Do I Have To Pay It Credit Karma

A Nanny Asks Questions About Form W 2

Have A Nanny Schedule H Guidance A How To

Nanny Tax Do You Have To Pay Taxes For A Caregiver Internal Revenue Code Simplified

Nanny Taxes 2018 For Nc Specifically Baking And Math

Do I Need To Pay Taxes For My Nanny

Nanny Pay Taxes Saint Paul Minnesota Tent Group

Nanny Taxes And Payroll Services Poppins Payroll Poppins Payroll

:max_bytes(150000):strip_icc()/woman-giving-her-daughter-to-nanny-157859358-7051092d95214d9b930da5dabb7a3d50.jpg)