philadelphia property tax rate 2022

Search for Philadelphia Property Taxes. Get help paying your utility bills.

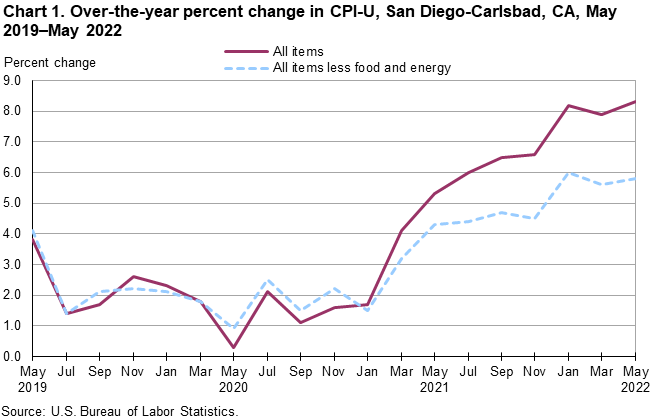

Consumer Price Index San Diego Area May 2022 Western Information Office U S Bureau Of Labor Statistics

Get home improvement help.

. Please note that the tool below only provides an estimate. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

The citys property tax rate is 13998 of the assessed property value. Create Philadelpia Property Tax Payment Online. Then receipts are distributed to these taxing authorities according to a predetermined plan.

The last citywide reassessment was for tax year 2020 based on values the Office of Property Assessment certified on or before March 31 2019. Only property owners whose values change will receive notifications. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Tax Year 2022 assessments will be certified by OPA by March 31 2021. Submit a service request with 311. There are three vital stages in taxing real estate ie devising tax rates estimating property market values and collecting receipts.

If you receive a property tax abatement are enrolled in LOOP or. But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan. Report a problem with a building lot or street.

The coronavirus pandemic disrupted the citys ability to conduct citywide property assessments for tax year 2022 leading officials to delay the reassessment for another year. Property Records by Just Entering an Address. Lawmakers are still hammering out the details to offset the proposed rates.

By phone by calling 877 309-3710. Philadelphia property tax rate 2022 Friday March 18 2022 Edit. Property owners can view their assessment for the 2023 tax year by searching for their address at propertyphilagov.

Request a circular-free property decal. Consultation of Philadelphia Property Tax Records. Get help with deed or mortgage fraud.

Continue to use our balance search website to pay your Real Estate Tax until October 2022. Taxing districts include Philadelphia county governments and various special districts such as public hospitals. The last citywide reassessment was for tax year 2020 based on values the Office of Property Assessment certified on or before March 31 2019.

Track a service request with 311. Just call 215 686-6442 and ask about our Real Estate Tax relief. Help is also available to veterans.

May 03 2022 As Philly braces for property value reassessments Kenney proposes wage tax reduction and other relief The real estate boom has increased the aggregate value of residential properties. Paying your Philly property tax online is always best. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments.

After that date this tax will be added to the Philadelphia Tax Center. Property Tax Invoice Philadelphia. The citys property tax rate is 13998 of the assessed property value.

2 How to Pay City of Philadelphia PA Property Taxes Online. For the 2022 tax year the rates are. Philadelphia property tax rate 2022 Friday March 18 2022 Edit.

Property owners can view their assessment for the 2023 tax year by searching for their address at propertyphilagov. The City of Philadelphias tax rate schedule since 1952. The reassessment of Philadelphias 580000 properties is expected to generate 92 million in additional property revenue for the city with the value of the average residential property up 31 from the last assessment.

The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022.

Search for Philadelphia Property. The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Buy sell or rent a property. Philadelphia PA 19105. Ad Find Philadelphia County Online Property Taxes Info From 2021.

PHILADELPHIA The Kenney administration is forgoing a citywide property reassessment. Just call 215 686-6442 and ask about our Real Estate Tax relief. The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022.

Be aware that under state law taxpayers can elicit a vote on proposed rate increases that surpass set ceilings. The city skipped reassessing property tax values for fiscal year 2021 and 2022 over concerns about the accuracy of how it valued property and pandemic-related issues. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate. Philadelphia must follow stipulations of the New York Constitution in levying tax rates. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

This Hgtv Couple Has The Most Stunning Mississippi Home

Transfer Tax Calculator 2022 For All 50 States

Best Mortgage Lenders Of 2022 If You Have A Bad Credit Score

Maryland Property Tax Calculator Smartasset

Pin On House Hunters Parsons Edition

The Average Amount People Pay In Property Taxes In Every Us State

Market Monday Mortgage Rates Have Been On The Rise But Homes Are Still Selling Rapidly Rates Are Projected To In 2022 Real Estate Tips Mortgage Rates How To Plan

The Average Amount People Pay In Property Taxes In Every Us State

The Average Amount People Pay In Property Taxes In Every Us State

Marblehead Ma Real Estate Marblehead Homes For Sale Realtor Com

Lively Discussions Spoken Here Financial Tip Photo

Fha Loan Closing Cost Calculator

Digital Currency Was In Computer Industry For 20 Years Send2press Newswire Memory Module Computer Memory 20 Years

Supreme Court Sides With Catholic Adoption Agency That Refuses To Work With Lgbt Couples

Mortgage Lending Plummets Across U S In Q1 2022 Attom

Cooling Real Estate Housing Markets In Us Uk Risk Deeper Global Economic Slump Bloomberg

The World In Brief The Economist

Economy Taxes What To Watch In 2022

Cheapest Places Where You Ll Want To Retire 2018 Best Places To Retire Great Places Places